AI Tools for Contract Risk Alerts

Explore how AI tools can transform contract management with real-time risk alerts, improving efficiency and compliance in legal teams.

AI Tools for Contract Risk Alerts

Managing contracts can be time-consuming and risky. AI tools now offer real-time risk alerts to flag problematic clauses, compliance issues, and deviations from pre-approved templates - cutting contract review times from 92 minutes to just 26 seconds. These tools help legal teams reduce errors, speed up decision-making, and ensure compliance without replacing human expertise. Below are six AI-powered platforms excelling in this space:

- Docgic: Tracks document changes, offers citation-backed answers, and provides 85% faster reviews for $29.99/month (Lawyer Plan).

- Luminance: Flags compliance risks using AI trained on millions of documents, with strong U.S. regulatory alignment.

- Evisort: Customizable alerts for key dates and compliance, with ISO-certified security.

- Kira Systems: Trusted by top law firms, it identifies over 1,400 clauses and reduces review time by 60%.

- Spellbook: Integrates with Microsoft Word for instant risk alerts and compliance checks.

- BlackBoiler: Builds digital playbooks for automated reviews, cutting contract review time by 70%.

These tools provide secure, efficient solutions for contract risk management, helping legal teams focus on high-value tasks while minimizing risks.

How AI Is Revolutionizing Contract Reviews for Legal Teams

1. Docgic

Docgic is an AI-driven platform designed to provide real-time alerts for contract risks. By combining precise document comparison tools with legal-focused AI, it helps streamline contract reviews and ensures potential issues are flagged instantly.

One standout feature of Docgic is its document comparison tool. It automatically tracks changes across contract versions, catching every modification - no matter how small. Problematic changes are visually highlighted, even in lengthy or complex documents, making it easier to manage multiple versions and stay on top of ongoing negotiations.

Another key offering is Docgic’s AI chat, which is equipped to understand legal terminology. This feature provides citation-backed answers, referencing specific contract sections, so legal professionals can quickly pinpoint and evaluate risks without sifting through pages of text.

By automating critical review tasks, Docgic significantly speeds up the process while reducing errors. According to the platform, it delivers reviews that are 85% faster, with 90% fewer errors, and doubles billable hours compared to traditional manual methods.

Security is also a priority for Docgic. The platform uses legal-grade security protocols to protect sensitive data during collaborative reviews, ensuring that confidential contract information stays secure.

For pricing, Docgic offers three plans tailored to different needs:

- Law Student Plan: Free, with basic features.

- Lawyer Plan: $29.99 per month, including advanced document analysis and enhanced comparison tools.

- Law Firm Plan: $99.99 per month, offering unlimited document processing, custom integrations, and enterprise-level security.

Additionally, Docgic includes tools for instant case law research and updates on current laws. These features help legal professionals spot not only obvious contract risks but also more nuanced compliance issues tied to recent legal developments.

2. Luminance

Luminance's compliance module is designed to detect contract risks immediately. Trusted by over 700 organizations, it utilizes AI trained on millions of legally verified documents to deliver accurate insights.

The platform uses real-time analytics to streamline contract compliance. Its automated alert system flags potential issues as soon as documents are uploaded. If compliance checks fail, the system escalates the issue to the compliance team with prioritized alerts. Luminance also tailors its checks to align with your business's unique obligations and risk profile, ensuring a customized approach to risk management .

Eleanor Lightbody, Luminance's CEO, emphasized that this feature transforms contract intelligence into actionable solutions for compliance teams.

Key Features

- Version Control and Insights: Luminance offers a configurable dashboard that provides a real-time view of risks across all active contracts. Its AI Insights Screen extracts critical data from both pre- and post-executed contracts, helping users track changes and identify risks without needing to manually review every version.

- Regulatory Alignment: The platform integrates seamlessly with the U.S. legal framework, running workflows that check internal policies and external sources, such as regulations and sanction lists. With recognition of over 1,000 predefined concepts, Luminance helps businesses navigate a constantly shifting regulatory environment . For example, it flags non-compliance issues like inadequate auditing rights, allowing teams to address them promptly.

- Data Protection: Luminance prioritizes data security with measures tailored to U.S. regulations. It complies with the EU-U.S. Data Privacy Framework and has certified adherence to the U.S. Department of Commerce's principles for handling personal data. The platform employs robust administrative, physical, and technical safeguards to prevent unauthorized data processing or accidental loss.

- Alerts Widget: This feature gives Sales and Procurement teams instant updates on contract termination dates, enabling them to secure renewals and identify upsell opportunities.

Security and Certification

Luminance is ISO27001 certified, ensuring high standards of data security. When transferring data internationally, the platform uses standard data protection clauses approved by governmental authorities. All data is stored securely on servers in Cambridge, United Kingdom, with established protocols for managing suspected data breaches.

With these features, Luminance stands out as a powerful tool for delivering instant alerts on contract risks and ensuring compliance in a complex regulatory landscape.

3. Evisort

Evisort offers a powerful system for contract risk monitoring, designed to keep legal teams informed about critical updates and deadlines. Its alert system can be customized to notify users about essential contract details, such as key dates, specific compliance requirements, or changes in language. Alerts can be set to run on an hourly, daily, or weekly schedule, depending on user needs. The platform's role-based access ensures that notifications are sent only to authorized stakeholders, and alerts can be customized for individual users or entire departments. Each notification includes direct email links to the relevant documents, seamlessly integrating with Evisort's broader compliance and configuration tools.

Advanced Alert Configuration

The Alerts module allows users to create highly tailored notifications. You can define a custom name, message, frequency (including start and end dates), and specify a folder scope. Advanced filters ensure that alerts are triggered only for contracts meeting specific criteria, making the system precise and efficient.

Regulatory Compliance and Risk Management

Evisort is built with a strong focus on regulatory oversight, particularly in the U.S. The platform scans contract language to identify compliance or non-compliance issues, flag clauses related to data privacy, enforce confidentiality terms, and track provisions tied to ESG (Environmental, Social, and Governance) goals. Its workflow automation ensures that contracts are created using the right templates and include the required terms before approval. Additionally, Evisort's AI continuously audits contracts for adherence to data privacy, security, KYC (Know Your Customer), AML (Anti-Money Laundering), and other industry-specific regulations.

A real-world example comes from a specialty insurance company, whose Chief Product Counsel shared:

"Our global specialty insurance company does business in many different parts of the world, so we need to stay on top of a range of compliance standards. We use Evisort's AI to keep our contracts up to date with the latest regulatory changes."

Security Certifications and Data Protection

Evisort has achieved ISO/IEC 42001 certification, along with ISO 27001 and ISO 27701 certifications, which validate over 150 security and privacy controls. Jonathan Price, Director of Security, highlights that these certifications provide critical reassurance in the face of evolving security threats.

The platform also employs advanced administrative and access controls to protect sensitive contract data during risk tracking and alert delivery. This secure framework ensures reliable and safe risk monitoring, even as organizations expand their contract management operations. These measures underscore Evisort's ability to deliver timely and secure alerts across all contract portfolios.

4. Kira Systems

Kira Systems, now part of Litera, is reshaping how contract reviews are handled by using lawyer-trained AI to provide real-time risk alerts. The platform can identify and extract over 1,400 clauses and data points across more than 40 key areas. With the ability to process over 250,000 documents monthly, Kira serves a user base of over 66,000 professionals, making it a trusted name in the legal tech industry.

Real-Time Document Comparison and Risk Detection

Kira stands out for its ability to pinpoint identical clauses across multiple documents with impressive speed and accuracy. Legal teams can use the platform to compare clauses or entire documents side-by-side, while also accessing aggregated data on clause frequency and relationships. This functionality makes it easier to spot unique clauses that could signal risks or opportunities. Additionally, Kira’s visual tools, such as tabular displays of smart fields, provide a clear, organized view of contract data. This level of precision ensures consistent risk identification across entire contract portfolios.

Trusted by Top Law Firms

Kira’s widespread adoption among leading firms speaks volumes about its effectiveness. It’s used by 64% of the Am Law 100 and 84% of the top 25 global M&A firms for contract reviews.

"Kira empowers our lawyers to work faster and more precisely, enhancing the overall quality of our due diligence process."

– Glenn LaForce, Chief Knowledge & Innovation Officer, Holland & Knight

Meeting U.S. Legal Standards

Kira ensures compliance with rigorous U.S. legal standards through its AI-driven document classification and grouping features. It organizes documents alongside related amendments, supporting accurate and thorough reviews.

Privacy is also a top priority for Kira. Alexander Hudek, CTO & Co-Founder of Kira Systems, emphasizes this commitment:

"Confidentiality is a cornerstone for relationships between law firms and their clients. Differential Privacy is the only technique available today that can guarantee the privacy required by law firms."

This dedication to privacy and compliance strengthens the platform’s integration into legal workflows.

Streamlining Workflows with Advanced Tools

Kira’s flexible workflows and optional generative AI smart summaries simplify the contract review process. The platform integrates seamlessly into existing legal systems, allowing teams to assign tasks, track progress, and conduct coordinated audits to identify critical clauses.

The results speak for themselves: Deloitte reported a 60% reduction in contract review time using Kira, while a global ride-sharing company achieved a 40% time savings through its AI-powered analysis. Additionally, Kira boasts a Net Promoter Score of 55, and users rate it 4.12 out of 5 stars on Cuspera.

sbb-itb-e7d4a5d

5. Spellbook

Spellbook takes AI integration to another level by embedding risk alerts directly into familiar legal software. Specifically, it brings AI-powered contract risk analysis into Microsoft Word, offering instant alerts to potential issues. This tool scans contracts to pinpoint critical sections, flag risks, and ensure compliance with legal standards. Trusted by over 3,000 law firms and in-house legal teams worldwide, Spellbook has handled more than 10 million contracts to date.

Real-Time Alerts and Compliance Monitoring

One of Spellbook's standout features is its side-panel that immediately highlights risks and deviations, allowing reviewers to focus on the exceptions that matter most. It automates compliance checks, flagging clauses that may not meet regulatory standards and spotting patterns that could indicate potential issues. What sets it apart is its ability to cross-reference contract clauses with specific legal regulations.

The system also delivers real-time alerts to close compliance gaps. It benchmarks contracts against the latest industry norms, identifying any deviations that might pose risks. For contract renewals, Spellbook takes care of extracting key dates, identifying missing clauses, suggesting updates, and even sending reminders.

"The capabilities of Reviews has blown away the expectations of our own team", says Scott Stevenson, Co-Founder and CEO of Spellbook.

Advanced Version Control and Playbook Integration

Spellbook simplifies version control with its Associate feature, which allows users to revisit any point in the editing process or compare drafts with previous agreements. This functionality, integrated seamlessly into Microsoft Word, sets it apart from standalone tools. The platform automatically generates redlines, compares drafts to past agreements, and populates renewal clauses using pre-approved templates.

Legal teams can also store negotiation playbooks for quick execution. The tool enables full document revisions based on instructions, whether repurposing precedents or adapting agreements to meet the requirements of new jurisdictions.

Users report completing initial contract reviews more than five times faster, uncovering risks that would typically take hours to find manually. Diego Alvarez-Miranda from CunninghamLegal shares:

"I love Spellbook. I use it every day. It saves me at least one hour, sometimes two hours, a day."

Tailored for U.S. Legal Practices

Spellbook adapts to the ever-changing U.S. legal environment with features designed to align with regulations like GDPR, CCPA, and the EU AI Act. Automated risk checks and compliance flagging make it easier for lawyers to stay up to date. Teams can upload their own compliance checklists, which Spellbook integrates into its review process.

The platform also lets firms create custom compliance rules. It updates templates to flag outdated clauses, ensuring contracts meet U.S. legal requirements. By identifying inconsistencies and missing clauses early, Spellbook smooths out the review process before agreements are finalized.

One user from NEAR Foundation highlights its efficiency:

"Every time I'm working on an agreement, Spellbook is open...it saves me 25-30% of my time."

Security You Can Trust

Spellbook is SOC 2 Type II compliant, offering top-tier data protection for sensitive legal documents. Its integration with Microsoft Word ensures a smooth workflow while preserving access to version histories.

The platform enhances audit transparency, allowing legal professionals to review and refine their work while ensuring AI-assisted drafting aligns with compliance standards. This reduces the risk of missing key clauses or failing to meet obligations during drafting, reviewing, or redlining.

With its ability to cut contract review times by up to 60% while improving accuracy, Spellbook empowers legal teams to work more efficiently without compromising on security or compliance.

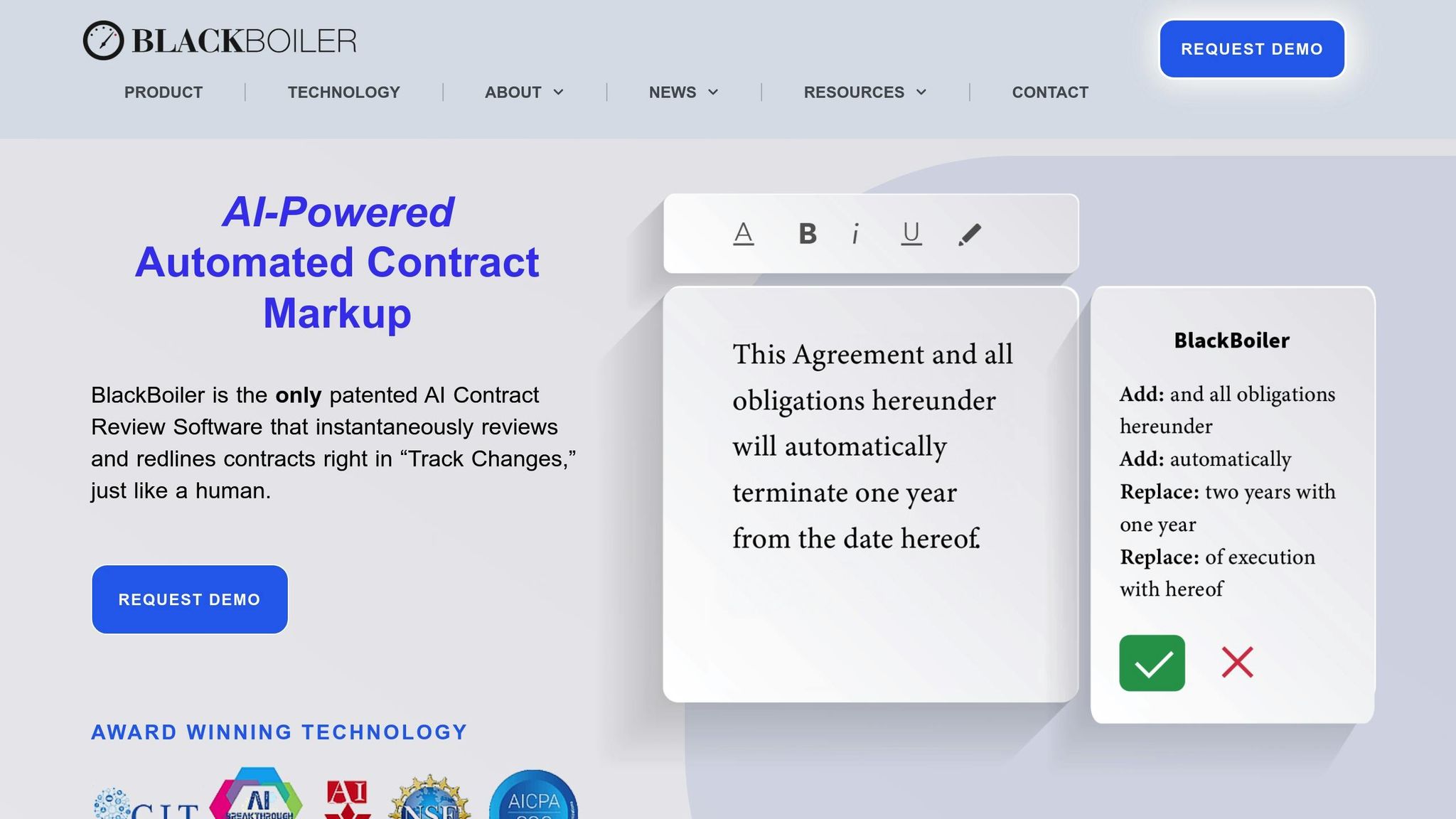

6. BlackBoiler

BlackBoiler has carved out a niche in the contract risk alert field by blending automated markup capabilities with smart risk detection. It doesn’t just stop at general contract review; instead, it builds systems that adapt to your organization’s specific needs. By creating personalized digital playbooks, BlackBoiler powers automated reviews while flagging risks in real time, ensuring every review is both efficient and insightful.

Automated Risk Detection with Digital Playbooks

At the heart of BlackBoiler’s offering is its ability to develop digital playbooks tailored to your organization’s contract standards. Its AI can identify discrepancies and suggest edits that align with your company’s established guidelines.

"BlackBoiler allows you to quickly build your own digital playbook for contract negotiation that powers automated review and markup. By building contract playbooks right in BlackBoiler, users can help mitigate risk and ensure compliance by automatically incorporating organizational and industry standards/company guidelines during the contract negotiation process."

– BlackBoiler

The platform’s ContextAI feature takes things a step further by providing detailed reasoning behind every redline or suggested change. This added transparency makes it easier for legal teams to assess and approve modifications, saving time and improving decision-making.

Proven Time Savings and Risk Management

BlackBoiler delivers tangible results for organizations looking to optimize contract reviews while keeping risks in check. For example, a Global 1000 company cut its review time from 45 minutes to just 14 minutes within six months - a 68.9% improvement. On average, BlackBoiler reduces review times by over 70%, all while maintaining high accuracy. Notably, the platform handles 66% of final contract edits, actively reducing risk by suggesting language that aligns with company policies.

Non-Generative AI for Precision

Unlike generative AI models, BlackBoiler uses a non-generative approach tailored to specific playbooks. This ensures that suggestions are relevant and accurate, avoiding the pitfalls of generic or incorrect recommendations. Its teachable AI learns from past contracts and company standards, constantly improving its performance. It also alerts project managers to deviations immediately, allowing for quick corrective actions before minor issues become major problems.

Top-Tier Security for Legal Data

Given the sensitive nature of legal documents, BlackBoiler employs enterprise-grade security measures. Client data is stored in isolated silos, accessible only to authorized users. The platform uses AWS cloud services with secure VPNs, tokens, and whitelists to control access. Data is encrypted at rest using AES256, and all transfers are secured with SSL connections. Additionally, BlackBoiler anonymizes uploaded contracts to ensure no personal information is retained. Multiple layers of access control and robust monitoring systems further protect data integrity.

For organizations handling large volumes of contracts, BlackBoiler combines automated risk detection, teachable AI, and rigorous security protocols to streamline reviews and minimize risks effectively. It’s a powerful tool for legal teams aiming to save time without compromising on quality or security.

Feature Comparison Table

Expanding on earlier discussions about the challenges of manual contract review, this comparison highlights the strengths of various AI tools designed for contract risk management. Choosing the right AI-powered solution hinges on factors like real-time alerts, document comparison accuracy, customization for U.S. legal standards, and security compliance. The table below outlines key features of leading tools in this space.

| Tool | Real-Time Alert Capabilities | Document Comparison Features | U.S. Legal Standard Customization | Security Compliance |

|---|---|---|---|---|

| Docgic | Instant risk detection with citation-backed alerts for deviations and compliance | Advanced comparison with version tracking and automatic citation detection | Customizable legal research with updates on U.S. laws and precedent analysis | Legal-grade security with enterprise-level data protection and SOC 2 compliance |

| Luminance | AI-powered alerts for anomalous clauses and risk patterns in real-time | Identifies changes across multiple contract versions using machine learning | Adaptable to U.S. legal frameworks with customizable risk parameters | Enterprise security with encryption, access controls, and audit trails |

| Evisort | Automated alerts for milestones, renewals, and compliance deadlines | Side-by-side comparison with highlighted differences and change tracking | Pre-built U.S. legal templates with customizable risk scoring for American law | SOC 2 Type II certified with encryption at rest and in transit |

| Kira Systems | Alerts for missing clauses, unusual terms, and regulatory compliance issues | Clause-level analysis with comprehensive markup capabilities | Extensive library of U.S. legal provisions with customizable extraction models | Bank-level security with ISO 27001 certification and multi-factor authentication |

| Spellbook | GPT-4 powered suggestions and risk warnings during drafting | Real-time comparison with Microsoft Word integration and change tracking | Built-in knowledge of U.S. legal standards with customizable firm-specific playbooks | Enterprise-grade security with data isolation and attorney-client privilege |

| BlackBoiler | Immediate deviation alerts through ContextAI with detailed reasoning for each flag | Automated markup and comparison against organizational playbooks | Fully customizable digital playbooks aligned with U.S. legal standards and policies | AES256 encryption, isolated data silos, and AWS cloud infrastructure |

The precision and speed of these tools depend on their AI models and the level of customization they offer. Document comparison capabilities range from basic version tracking to advanced analysis that can detect subtle differences and flag potential risks.

Customization for U.S. legal standards ensures alerts align with specific regulatory needs. Tools with pre-configured playbooks and extensive legal provision libraries often deliver accurate alerts right from the start, minimizing setup time.

With the average cost of a data breach projected to reach $4.88 million in 2024, focusing on platforms with SOC 2 compliance and robust encryption is critical. Research shows that organizations using strong AI security measures can identify and contain breaches 108 days faster, saving an average of $1.76 million in response costs.

When evaluating vendors, ask questions like:

- Where is client data stored?

- Is client or firm data used to train models?

- How is legal privilege protected?

The answers to these questions will guide you toward a solution that balances powerful AI capabilities with stringent security and compliance requirements. This comparison underscores how these tools can streamline and secure contract risk management effectively.

Conclusion

AI-powered tools are reshaping contract risk management and redefining the way legal professionals operate. By adopting AI-driven contract lifecycle management solutions, organizations report impressive results: 45% improvement in operational efficiency during negotiations and supplier contract creation, 35% reduction in contract cycle times, and a fivefold decrease in noncompliance-related losses. David Li, partner at White & Case, offers a compelling example:

"On the corporate side, White & Case uses an AI-enabled due diligence and contract review platform, Luminance, to help lawyers summarize key contractual provisions quickly and with more efficient allocation of resources and 30-40% of cost savings".

Legal automation is making a significant impact, with AI handling approximately 44% of tasks within legal services. Considering that lawyers spend 40% to 60% of their time drafting documents and reviewing contracts, this technology frees up valuable time for strategic analysis and client-focused work. AI also excels at analyzing data and identifying risks that may go unnoticed during traditional reviews, a critical advantage as contracts grow in complexity and compliance demands increase.

The legal industry is increasingly embracing AI, as reflected in market trends. 36% of lawyers predict AI tools will become mainstream within five years, and the market for AI software in legal services is projected to expand from $2.19 billion in 2024 to $3.64 billion by 2029. These figures highlight the competitive edge available to early adopters.

For U.S. legal professionals, AI offers transformative benefits: real-time risk alerts, improved compliance monitoring, and streamlined workflows. These tools are designed with a common purpose - to make contract risk management more accurate, efficient, and dependable, enabling legal teams to deliver better client outcomes while cutting costs.

FAQs

How can AI tools for contract risk alerts help streamline contract management and reduce errors?

AI tools designed for contract risk alerts make managing contracts much easier by automating repetitive review tasks and providing instant notifications about risks or changes. Using technologies like machine learning and natural language processing, these tools can quickly spot issues such as compliance gaps, inconsistencies, or potential liabilities.

By cutting down on the need for manual reviews, these tools boost precision and efficiency, giving legal teams more time to focus on complex, strategic work. This not only reduces errors but also enhances productivity and supports better decision-making throughout the contract management process.

How does Docgic ensure the security of sensitive contract data?

Docgic places a strong emphasis on safeguarding sensitive contract data through a range of advanced security protocols. These include encryption to protect data both while it's stored and during transmission, multi-factor authentication to add an extra layer of security, and strict access controls to limit information access to authorized users only.

The platform also integrates continuous monitoring to identify and respond to potential threats in real time, input validation to block unauthorized data changes, and audit logging to keep a detailed record of system activity. Together, these features create a secure space for legal professionals to manage contracts while adhering to industry regulations.

How do AI tools adapt risk alerts to meet specific legal and compliance requirements?

AI tools are transforming how risk alerts are managed by embedding legal standards and compliance requirements directly into their algorithms. This means they can track contract changes in real-time and issue alerts that align with current regulations and organizational policies.

Some standout features include policy mapping, integration of regulatory updates, and automated risk assessments. These capabilities ensure the alerts are precise and consistently aligned with legal guidelines, helping legal professionals stay ahead of potential risks while simplifying compliance efforts.